When financial emergencies strike, you need money fast. Traditional part-time jobs require applications, interviews, and waiting weeks for your first paycheck. But what if you could start earning emergency money within days? Rideshare driving with Uber or Lyft offers a proven way to generate quick cash when you’re facing unexpected bills, job loss, or other financial crises.

This isn’t about building a career – it’s about surviving a financial emergency. Here’s how rideshare driving can serve as your Money 911 strategy when you need flexible income immediately.

Why Rideshare Driving Works as Emergency Money

Unlike other quick cash strategies, rideshare driving requires minimal startup costs and can begin generating income within 48-72 hours of approval. You’re not selling possessions or taking on debt – you’re leveraging an asset you already own: your car.

Key advantages for emergency situations:

- No interview process or waiting period

- Start earning within days of application

- Work as many or as few hours as needed

- Cash out earnings instantly with most platforms

- No long-term commitments

Getting Started: Your 72-Hour Action Plan

When facing a financial emergency, every hour counts. Here’s your quick-start roadmap:

Day 1: Application and Requirements

- Complete online applications for both Uber and Lyft

- Gather required documents: driver’s license, insurance, vehicle registration

- Schedule vehicle inspection (many auto shops offer same-day service)

- Order background check if not automatically processed

Day 2: Account Setup

- Upload required documents

- Complete any remaining verification steps

- Download driver apps and familiarize yourself with interfaces

- Research high-demand areas in your city

Day 3: Start Driving

- Begin with short drives to learn the platforms

- Focus on busy areas during peak hours

- Track earnings and expenses from day one

Most drivers receive approval within 2-7 days, making this one of the fastest ways to start earning emergency money.

Maximizing Your Emergency Income

When you’re in financial crisis mode, every dollar matters. Strategic driving can significantly boost your hourly earnings:

Peak Hour Strategy

Target these high-demand periods:

- Morning rush: 7:00-9:00 AM (weekdays)

- Evening rush: 5:00-7:00 PM (weekdays)

- Weekend nights: 10:00 PM-3:00 AM (Friday/Saturday)

- Airport runs: Early morning and late evening flights

Surge Pricing Opportunities

- Monitor surge pricing notifications

- Position yourself near event venues during concerts or games

- Drive during bad weather when demand spikes

- Work holidays when regular drivers take time off

Multi-Platform Approach

Running both Uber and Lyft simultaneously increases ride opportunities:

- Accept rides from whichever platform offers better rates

- Reduce downtime between passengers

- Take advantage of platform-specific bonuses

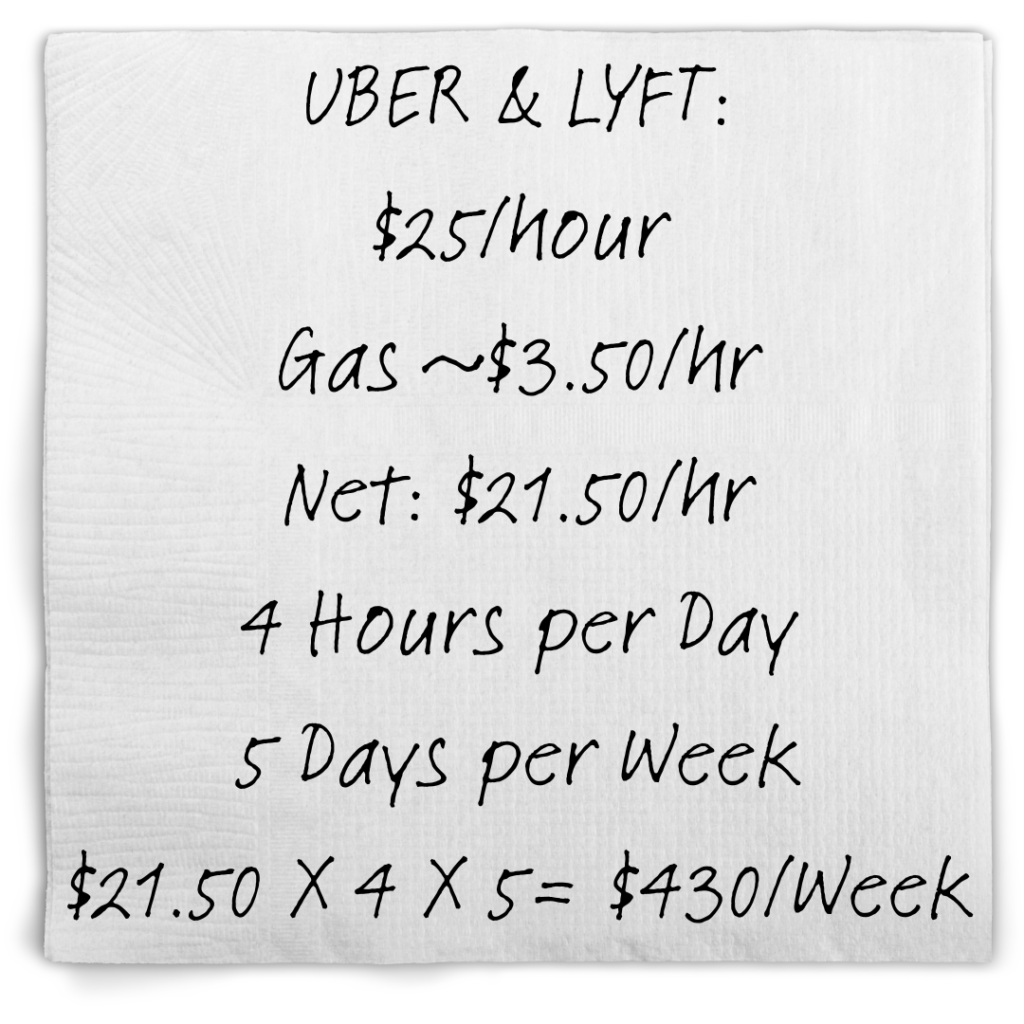

Realistic Emergency Earning Expectations

Understanding potential earnings helps set realistic goals for your Money 911 situation:

Part-Time Emergency Schedule (20 hours/week)

- Conservative estimate: $250-400 per week

- Aggressive peak-hour driving: $400-600 per week

- Major city with surge pricing: $500-800 per week

Full-Time Crisis Mode (40+ hours/week)

- Standard driving: $500-800 per week

- Strategic peak-hour focus: $800-1,200 per week

- High-demand markets: $1,000-1,500 per week

Note: Earnings vary significantly by location, time investment, and driving strategy. These figures are before expenses like gas, maintenance, and taxes.

To help you get a realistic picture of what’s possible, see below for “napkin math.”

Managing Expenses During Financial Crisis

When every dollar counts, tracking expenses becomes critical:

Immediate Costs

- Gas: 15-25% of gross earnings

- Vehicle maintenance: Set aside $0.10-0.15 per mile

- Phone plan: Ensure unlimited data for GPS and apps

Tax Considerations

- Track all miles driven for business

- Save 25-30% of earnings for taxes

- Consider quarterly payments if earning substantial amounts

Vehicle Wear Awareness

Rideshare driving accelerates vehicle depreciation. During financial emergencies, focus on:

- Regular oil changes and tire rotations

- Monitoring brake wear from frequent stops

- Keeping detailed maintenance records

Quick Cash Strategies Beyond Standard Rides

Maximize your emergency earning potential with these additional services:

Delivery Services

- Uber Eats/DoorDash: Lower vehicle wear, flexible scheduling

- Grocery delivery: Higher tips, especially from elderly customers

- Pharmacy runs: Quick trips with good compensation

Premium Services

- Uber Black/Lyft Lux: Higher rates for newer, luxury vehicles

- Airport specialization: Longer trips, premium pricing

- Corporate accounts: Consistent, professional clientele

When Rideshare Driving Makes Sense for Your Money Emergency

This strategy works best when:

- You have a reliable vehicle with current registration and insurance

- Your car is 15 years old or newer (platform requirements vary)

- You can drive safely for extended periods

- You live in or can access areas with decent population density

- You need money within days, not weeks

Red flags to consider:

- Vehicle needs major repairs

- You lack proper insurance coverage

- Physical limitations prevent safe driving

- You live in very rural areas with limited demand

Building Your Emergency Fund While You Drive

Once you’ve addressed your immediate crisis, use continued rideshare income to prevent future Money 911 situations:

Emergency Fund Goals

- Start with $500 for small emergencies

- Build toward one month of expenses

- Eventually target 3-6 months of living costs

Smart Money Moves

- Open high-yield savings account for emergency funds

- Automate transfers of 20-30% of rideshare earnings

- Consider this temporary income while building more stable revenue streams

Transitioning Away from Emergency Driving

Remember: rideshare driving is your financial bandage, not your long-term solution. As your situation stabilizes:

Exit Strategy Planning

- Use the flexible schedule to job hunt or build skills

- Network with passengers in your industry

- Leverage the income stability to pursue better opportunities

- Maintain driving capability as backup income source

Long-Term Financial Health

- Address root causes of financial emergencies

- Build multiple income streams

- Develop emergency fund to avoid future crises

- Consider rideshare driving as occasional supplemental income

Your Money 911 Action Steps

If you’re facing a financial emergency right now:

- Today: Apply to both Uber and Lyft platforms

- This week: Complete vehicle inspection and background checks

- Next week: Begin driving during peak hours

- Within 30 days: Establish sustainable earning routine

- Within 90 days: Build emergency fund and plan transition strategy

Financial emergencies don’t wait for the perfect solution. Rideshare driving offers immediate earning potential with minimal barriers to entry. While it’s not a career path, it can provide the quick cash you need to weather your financial storm and buy time to implement longer-term solutions.

Start your applications today. Your financial emergency solution could be just a few days away.